Cryptoassets such as Bitcoin and Ethereum are known for their extreme price volatility 📈. Unlike fiat currencies which incorporate various price stability mechanisms, cryptocurrencies rely on much simpler models of fixed total coin supply and pre-defined block rewards. In many cases the entire coin supply is pre-mined, leaving no room for change. One could say that cryptocurrencies lack "monetary policy".

Furthermore, the term "cryptocurrency" is somewhat misleading and often gives false expectations as to the features of Bitcoin and alike. Bitcoin and Ethereum cannot perform the three functions of money: unit of account, means of payment and store of value. Instead, both cryptocurrencies encourage hoarding and speculation. Bitcoin is already seen as an alternative to Gold, and we are witnessing 20% of users not touching their Bitcoin investments for more than three years (see chart below). It is to be expected this percentage to decrease in the next bull run. Ethereum, on the other hand, has seen the rise of Decentralised Finance (DeFi) and Decentralised Lending, both of which encourage users to hoard ether and lock it in smart contracts as collateral.

The need for a stable value of transfer in the crypto space has always been a desired feature. These new types of assets have attracted a lot of attention recently, both from private companies such as Facebook and central banks. Stablecoins, as the name suggests, are designed with one thing in mind - minimising price volatility.

"Stablecoins are meant to allow the exchange of an inherently volatile crypto-asset into a less volatile asset without leaving the crypto-ecosystem.", European Central Bank (ECB), 2019

Before the rise of stablecoins, the only safe haven for investors and traders were fiat currencies. If people sought stability, they would exchange their bitcoins for USD, EUR, CNY or JPY.

Types of Stablecoins

There are two main classes of stablecoins with their respective categories and subcategories: (1) backed and (2) algorithmic.

Backed stablecoins as the name suggest are supported by collateral 💰 stored either on-chain or off-chain. The collateral is represented by a wide range of asset classes: USD dollars, gold, other cryptocurrencies like for example ether. Algorithmic stablecoins are not backed by any value just like Bitcoin. Unlike Bitcoin, these coins introduce a "monetary policy" into their systems, which is sometimes entirely reliant on algorithms or governance mechanisms. Ampleforth (AMPL), for example, relies on algorithmic money supply adjustments. NiBits (USNBT), another stablecoin relies on a governance mechanism of shareholders where assets get taken out of circulation based on governance decisions.

Backed Stablecoins

On the one hand, backed stablecoins outperform the algorithmic ones when it comes to price stability, but on the other hand, backed coins are often a subject to higher centralisation. Centralisation could take many forms:

- Centralised collateral storage

- Centralised governance models

- Dependence on specific collateral type (USD, EUR, etc.)

- Becoming subject to regulations

Tokenised Funds

As the name suggests, these stablecoins are backed by funds: central bank money or commercial money. Another property is that they require a custodian. The best example of a tokenised fund would be Tether (USDT). Introduced in 2014 Tether is one of the first stablecoins in the crypto space and it is still the most widely used stablecoin with over 90% trading volume compared to the overall stablecoin market.

All tethers are pegged at 1-to-1 with a matching fiat currency (e.g., 1 USD₮ = 1 USD) and are backed 100% by Tether’s reserves., tether.to

Tether claims that each coin is 1:1 convertible into fiat upon request by the user. The way Tether manages its token supply is to deposit fiat currency into the company bank account while issuing on-chain tokens. USDT is one of the most stable coins in the crypto space showing the lowest volatility. Thether is not the only tokenised fund. Gemini dollar (GUSD), another stablecoin works on the same principle. Binance (BUSD) and Coinbase (USDC) have also introduced their own stablecoins. We see a trend where big cryptocurrency exchanges introduce their stablecoins.

All tokenised funds have one thing in common: high centralisation. These funds are managed by financial institutions while acting as custodians and could be an easy target for regulators. Upon government request companies like Tether/Gemini/Binance could blacklist ⛔️ any user or blockchain address from exchanging their token holdings for Bitcoin or fiat currency. These are not trustless systems. In essence, individuals are trusting the regulatory regime in which these stablecoins reside.

Pros

- Near zero exchange rate risk (par)

- User friendly (from usability prespective)

- Redeemable as fiat money (in most cases)

- Fully backed by fiat currency

- Resistible to market crashes

Cons

- Higher degree of centralisation (a company acts as middleman)

- Subject to government regulation (can be seen as a pro, depending on POV)

- Subject to address backlisting and bans

- Sometimes difficult to audit

Off-chain Collateralised Stablecoins

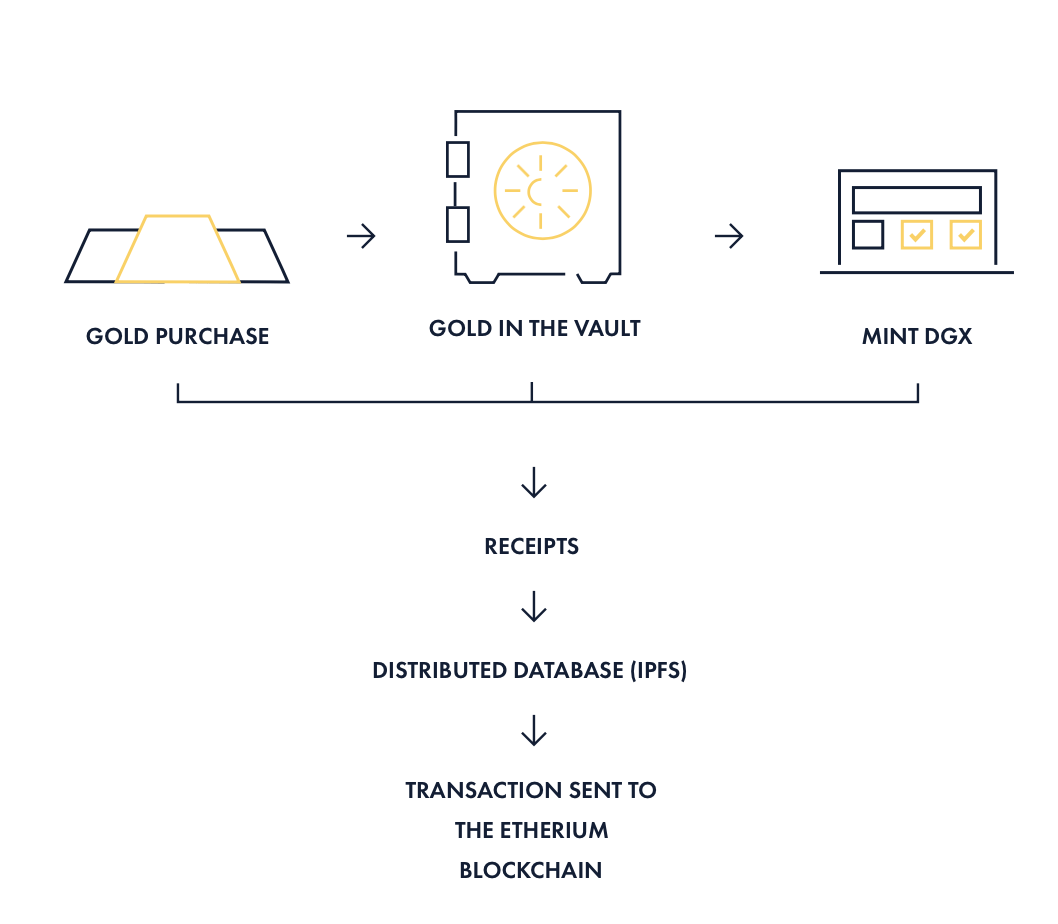

Such stablecoins are backed by other traditional asset classes: commodities, securities, etc. Similar to tokenised funds, these types of stablecoins introduce custodians as middlemen. One example would be Digix, which is in the business of Gold coins. The DGX token is pegged to the price of Gold. The Gold is held in company vaults. One DGX represents one gram of Gold, and it is fully redeemable upon request. Calling DGX stable might be inaccurate since the price of Gold is also volatile. Nevertheless, DGX relies on the same mechanism of stable exchange rate between the token and the underlying collateral.

Off-chain collateralised stablecoins are also a subject to high centralisation. A user has to rely on its custodian for keeping the collateral safe. The off-chain collateral is also subject to government legislation and possible confiscation.

On-chain Collateralised Stablecoins

Even though on-chain collateralised stablecoins are not widely used in the industry, they certainly attract the biggest attention because of their future potential. These assets are part of the Decentralised Finance (DeFi) movement and range from stablecoins to synthetic assets of any kind. The best known on-chain collateralised stablecoin is Dai which is developed by Maker.

“On-chain collateralised stablecoins” are backed by assets, typically crypto- assets, which are recorded in a decentralised manner and do not need either an issuer or a custodian to satisfy any claim., European Central Bank (ECB), 2019

Dai is created when a user locks down ether or other accepted crypto tokens in a smart contract. The ether is used as collateral to issue Dai stablecoins. The collateral remains locked until the user pays back the amount of borrowed Dai. The mechanism for issuing Dai is called Collateralised Debt Position (CDP). The system is designed in a way that there must always be excess collateral. The recommended collateralisation for a Dai CDP is 250%. If the price of ether falls too fast, there is a risk of liquidation, where users lose their collateral and pay a penalty fee. However, they get to keep their Dai tokens.

Challenges

On-chain collateralised stablecoins are subject to higher price volatility compared to the ones mentioned above. In March 2020 worldwide stock market meltdown managed to hit the crypto space. Dai faced enormous liquidity shortage. In addition to that, the Ethereum network faced a spike in the transaction fees. Investors were looking for a store of value in the face of stablecoins and sold their Bitcoin and other cryptocurrencies for Dai. In the meantime, ether tanked from $200 to $80, which put enormous pressure on the collateral. As a result, the Dai price was floating above one dollar with a peak at $1.05. The result of the meltdown was that CDPs got under-collateralised. The outcome for Dai was a loss of 30,000 ETH and angry investors. As of today, Dai is stable again.

Pros

- Higher decentralisation

- Users don't have to leave the crypto ecosystem if they seek price stability

- Cannot be seized by a government entity

- Auditable

Cons

- Less stable compared to off-chain collateralised assets

- Higher risk of software bugs and hacks

- Stablecoins governed by DAO structures are susceptible to plutocracy

Algorithmic Stablecoins

Algorithmic, also known as intervention-based stablecoins, don't require the custody of any underlying asset. Instead, these stablecoins rely on: (1) supply adjustments or/and (2) asset transfers for stabilising their prices. An algorithmic stablecoin could depend on just one or both rules. What do I mean by stable prices? We are talking about the exchange rate with the US dollar.

One of the first algorithmic stablecoins from 2014 is NuBits. A core concept of NuBits is the "park rate":

"Parking is when a holder of NuBits volunteers to have all the outputs associated with a particular address placed in a parking transaction in exchange for a promise from the network that when the funds are unparked they will have a larger amount of NuBits.", NuBits Whitepaper, 2014

Essentially NuBits pays an interest rate on term deposits. The idea behind this is that by controlling the interest rate NuBits will be able to pull coins from circulation, thus reducing the total available supply. NuBits is a two-token system: NuBits and NuShares. NuShares are part of a governance mechanism. The holders of NuShares (shareholders) are the ones setting the park rates. Additional supply mechanism is the creation of new coins. Shareholders can decide when to mint new tokens. Minting is used for expanding the available NuBits supply. The NuBits team also held a small quantity of Bitcoin reserves which was used to support the price when needed.

How NuBits lost its peg to the US dollar

In 2016 NuBits lost its peg to the dollar and remained underpriced for three months. Around that time, Bitcoin experienced a huge price spike. People holding NuBits wanted to sell their stablecoin for Bitcoin. NuBits could not keep up with the selling pressure and lost its peg to the dollar. There were reports that 10% of the NuBits supply was put for sale in 12 hours.

In March 2018 NuBits again lost its peg to the dollar. Since then, NuBits never recovered its peg. One of the reasons for that was the lack of sufficient reserves to support the price. After the team ran out of reserves and the trust in the stablecoin was gone, the price never recovered. As of today, the team is trying to recover the peg with the help of investors.

Ampleforth Protocol

Ampleforth (AMPL) is an algorithmic cryptocurrency which does not claim to be stable. I am putting it on the list because this is one of the newest algorithmic cryptocurrencies on the market and it is one of the most interesting ones. Ampleforth is synthetic commodity money which relies on a rebase mechanism which aims to hold the price of AMPL in the target range around one dollar. The target range changes over time with the inflation of the USD. The idea behind this is to counter the inherited inflation by fiat currencies. While other stablecoins will always aim at one dollar, AMPL price should adjust for inflation, thus increasing its price against the dollar.

At the end of every 24 hours, the supply could change. When there is a supply increase or decrease, everyone's token holdings will undergo the same change proportionally. If you hold 1% of the total AMPL supply, you will still own 1% after the rebase, no matter in which direction the supply changes. From a user's perspective, this would mean that their token holdings could change every 24 hours, but their share of the system will stay the same.

Here is a brief overview of the AMPL rebase mechanism:

- Oracle rate above approximately $1.061 is positive rebase - supply increases 🔼

- Oracle rate between $1.061 - $0.961 no rebase - no change in supply ↔️

- Oracle rate below $0.961 negative rebase - supply goes down 🔽

Algorithmic stablecoins pros and cons:

Pros

- Fully decentralised

- Cannot be seized by a government entity

- Users don't have to leave the crypto ecosystem if they seek price stability

- Auditable

- Not reliant on collateral

Cons

- Less stable compared to backed stablecoins

- Vulnerable to market crashes

- Still very experimental

Hybrid Stablecoin Systems

Some developers are building stablecoins based on hybrid modes. Neutrino, for example, is a stablecoin which is backed by on-chain collateral and regulated by stabilising algorithm. The system works by locking Waves tokens (Waves is the native token of the Waves blockchain) as collateral and generating Neutrino coins (USD-N) which are pegged to the US dollar. The first step is very similar to the Dai stablecoin generating mechanism. The stabilising algorithm is trying to address a common issue with on-chain collateralised stable coins - the sudden value drop of the collateral. Neutrino's stabilising algorithm uses a system of oracles monitoring the price of the Waves collateral. If the price of Waves falls, the smart contract issues and sells Neutrino bonds (USD-NB). If the opposite happens, the smart contract liquidates USD-NB bonds purchased on the open market for 1 USD-N each. Since the bonds were issued at a price below one dollar, the bondholders profit from the sell.

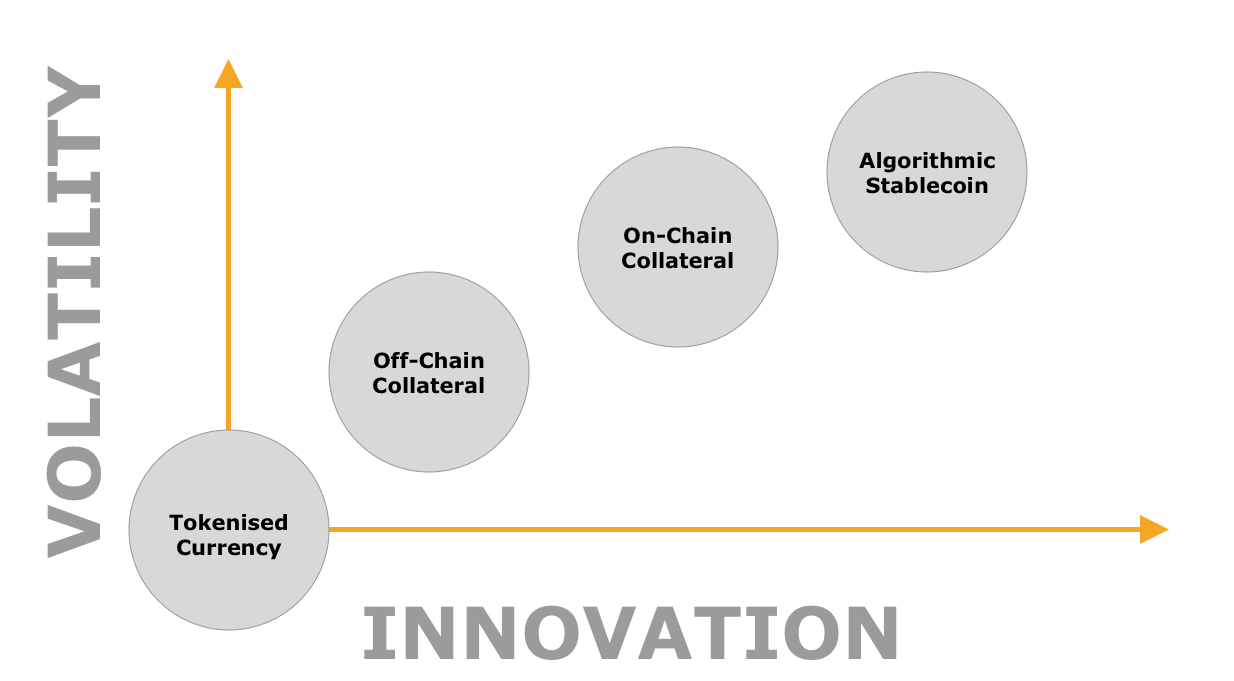

Category assessment

Based on the categories innovation and volatility, we can construct a chart with the different stablecoin types. One can see that the more innovative stablecoins experience higher price volatility.

Where does Facebook's Libra fit into the Picture?

Facebook announced its intention to issue a stablecoin called Libra on top of its in-house developed blockchain. The initial idea was to create a stablecoin backed by a basket of fiat currencies, including USD, EUR, JPY, GBP, SGD. Facebook faced enormous pushback from world governments and was forced to change its strategy. Currently, the first version of Libra will be backed only by US dollars. The properties of Facebook's stablecoin are similar to Tether. We could label it as a tokenised fund, controlled by a centralised entity (The Facebook Association). Libra won't rely on public blockchain infrastructure. The blockchain consensus mechanism will probably be permissioned proof-of-authority system (PoA).

China is also looking into Stablecoins

China might soon launch its own cryptocurrency. Experts anticipate China to issue tokenised renminbi (RMB) on its government blockchain. People expect that the RMB stablecoin will have the properties of a tokenised fund, just like Tether. The off-chain collateral could be RMB fiat currency backing the stablecoin. More interesting would be the next steps for the RMB stablecoin. Having a government currency issued on a blockchain will enable people to develop blockchain financial instruments for the government currency.

References:

- Bitcoin as money?, cryptochainuni.com

- China’s virtual currency could be launched ‘quite soon,’ says fund manager, CNB

- End of a stablecoin, JP Koning Blog

- It is time for immediate use of tier 6 liquidity (NSR shares), NuBits Forums

- Neutrino stablecoin, Medium.com

- NuBits whitepaper, Nubits.com

- Stablecoins – no coins, but are they stable?, European Central Bank

- SoK: Demystifying Stablecoins, Jeremy Clark, Didem Demirag, Seyedehmahsa (Mahsa) Moosavi

- The End of a Stablecoin — The Case of NuBits, Medium

- Virtual Currency Bitcoin in the Scope of Money Definition and Store of Value, Max Kubat

- What on-chain analytics tell us about Bitcoin transactions in 2020, Cointelegraph.com